...

...

Charles Fehr and co-workers at

Firmenich have designed the "right cat for the desired

odor". In WIPO Patent Application

WO/2009/141781

(November 26, 2009), they disclose a novel, and seemingly

practical, approach to the synthesis of beta-Santalol (the

Golden Grail of Sandalwood odor).

See also - Charles Fehr,

Iris Magpantay, Jeremy Arpagaus, Xavier Marquet, Magali

Vuagnoux,

Enantioselective

Synthesis of (-)-beta-Santalol by a Copper-Catalyzed Enynol

Cyclization-Fragmentation Reaction, Angewandte Chemie,

Volume 121, Issue 39, Date: September 14, 2009, Pages:

7357-7359

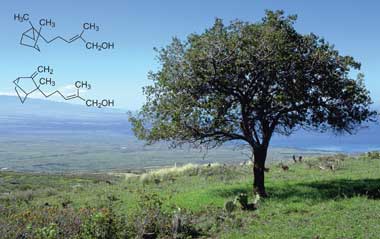

β-Santalol is an

organic compound that is classified as a

sesquiterpene. It comprises about 20% of the oil of

sandalwood, the major component being

α-santalol. As of 2002, about 60 tons of sandalwood oil are produced annually by

steam distillation of the heartwood of

Santalum album.

[1]

References

- Karl-Georg

Fahlbusch, Franz-Josef Hammerschmidt, Johannes Panten, Wilhelm

Pickenhagen, Dietmar Schatkowski, Kurt Bauer, Dorothea Garbe, Horst

Surburg "Flavors and Fragrances" in Ullmann's Encyclopedia of Industrial Chemistry, Wiley-VCH, Weinheim: 2002. Published online: 15 January 2003; doi:10.1002/14356007.a11_141.

Out of the woods

Woody

fragrances such as Iso E Super, a compound known as a 'floraliser' and

used in most new fine fragrances, also rate highly, says Gautier. Some

people smell a cedarwood note in Iso E Super, while others perceive it

to be musky. The male fragrance Fahrenheit (Dior, 1988) is 25 per cent Iso E Super while Perles de lalique

(Lalique, 2007) is 80 per cent Iso E Super. The commercial Iso E Super

owes its woody smell to a 5 per cent impurity which has an odour

threshold about 100 000 times lower than that of the main product.

Alpha- (top) and beta-santalol are constituents of the prized East Indian sandalwood oil

|

In

1999, Kraft's team at Givaudan isolated this impurity by epoxidation of

a commercial Iso E Super and proposed a structure based on NMR spectra.

The team came up with a way to synthesise the compound but it was not

commercially viable and the structure turned out to be too complex for

an alternative synthetic procedure. But out of several synthesised

analogues, one had an almost equal odour threshold and smelled even

better. What is more, its industrial synthesis is straightforward and it

has become a big hit - used by Givaudan as the captive material

Georgywood.

However, on strictly cash terms, the

most valuable fragrances are the natural products. For example, East

Indian sandalwood oil is one of the most precious and expensive

perfumery raw materials.

Beta-santalol is the main

olfactory constituent of sandalwood oil. It wasn't until 1990 that

beta-santalol could be prepared in the lab - this took an 11-step

reaction that was unsuitable for industrial scale-up. The best

sandalwood oil substitutes are derivatives of alpha-campholenic

aldehyde, prepared from inexpensive alpha-pinene, most of which is a

byproduct of the paper industry.

'The components in

sandalwood oil are not easy to make,' acknowledges Gautier. 'But what

Firmenich has done is screened all around that kind of structure to try

to find woody notes. We have a lot of substitutes so that perfumers can

create something close to sandalwood without needing sandalwood oil.'

Kraft agrees that there are 'excellent synthetic substitutes' out there.

For example, the campholenic aldehyde derivatives typically have a good

sandalwood smell. 'The other olfactory parts of natural sandalwood oil -

such as the smokey, cedar-like aspects - can easily be added using, for

example, cedarwood oil,' says Kraft.

Sandalwood was initially quite cheap (Guerlain's Samsara

contained 25 per cent sandalwood) but overharvesting has led to Indian

sandalwood trees being listed on the World Conservation Union's

threatened species red list.

'There's still a good

market for sandalwood oil and the price has gone, in the past six or

seven years, from $1000 [£680] per kg to over $2000,' says Leffingwell.

One Australian firm, TFS Corporation, has taken the initiative and

planted over 1700 hectares of the endangered Indian sandalwood (Santalum album ) in plantations in Western Australia.

http://www.google.com/patents/WO2009141781A1?cl=en

A) Preparation of β-santalol (via Wittig and hydroxyalkylation reaction)

A solution of butyllithium in hexanes (1.35 M, 11.7

ml, 15.8 mmol) was added over a 15 minutes period to a stirred

suspension of ethyltriphenylphosphonium iodide (6.61g, 15.8 mmol) in THF

(125 ml) at 0

0C. The resultant red solution was cooled to

-78°C and 3-(2-methyl-3-methylene-bicyclo[2.2.1]hept-2-exo-yl)-propanal

(2.55 g, 14.33 mmol) in solution in THF (16 ml) was added over a 15

minutes period. After further 5 minutes at -78°C, a solution of

butyllithium in hexanes (1.35 M, 12.7 mL, 17.2 mmol) was added over a 5

minutes period and the mixture was further stirred for 20 minutes at

-78°C before allowing to reach 0

0C in 2 hours. Dry

paraformaldehyde (2.60 g, 86.0 mmol) was added in one portion to the

deep red homogeneous solution and the mixture was stirred for 30 minutes

at 0

0C and was allowed to reach room temperature. After 1

hour at room temperature the mixture was poured into 5.2 ml of saturated

aqueous solution of NH

4Cl and extracted twice with CH

2Cl

2. The organic layer was washed with water and brine, and dried with Na

2SO

4.

The mixture was filtered through a short pad of silica gel with

dichloromethane as eluent and solvents were removed under pressure to

give a crude. Purification of crude compound was performed by flash

chromatography on silica gel with cyclohexane/AcOEt 90/10) as eluent to

give pure β-santalol as pale yellow oil. Further bulb to bulb

distillation under reduced pressure afforded β-santalol in 50% yield

(Z:E=95:5). 1H NMR (CDCl

3, 400 MHz): 5.29 (t, J=7.5, IH),

4.73 (s, IH), 4.45 (s, IH), 4.14 (s, 2H), 2.66 (d, J=3.8, IH), 2.12-1.94

(m, 3H), 1.78 (d, J=I.2, 3H), 1.71-1.60 (m, 3H),

1.44-1.36 (m, 2H), 1.32 (br s, IH), 1.27-1.17 (m,3H), 1.04 (s, 3H).

13C NMR (CDCl

3, 125 MHz): 166.2, 133.9, 129.0, 99.7, 61.6, 46.8, 44.7, 44.6, 41.5, 37.1, 29.7, 23.7, 23.2, 22.6, 21.2.

B) Preparation of β-santalol (via [1,4]

hydrogenation) i) Preparation of a compound (V):

2-methyl-5-(2-methyl-3-methylene-bicyclo[2.2.1]

hept-exo-2-yl)-pent-2-enal

3-(2-Methyl-3-methylene-bicyclo[2.2.1]hept-2-exo-yl)-propan-l-al (274.0 mg,

1.54 mmol) was dissolved in toluene (15.0 ml) at room

temperature under nitrogen. The mixture was heated to reflux and

propionaldehyde (0.4 ml, 1.96 mmol) and aqueous catalytic solution of

hexamethyleneimine and benzoic acid (0.12 ml, 0.616 mmol) was separately

added in one portion. Once that addition was finished, the mixture was

further heated at reflux for 6 hours. The mixture was cooled down to

room temperature and extracted twice with brine, the organic layer was

dried over MgSθ

2, filtered off and concentrated to give a

crude which was further purified by flash chromatography with

cyclohexane/ AcOEt (95/5) to afford the title compound in 80% yield.

1H NMR: 9.38 (s, IH), 6.48 (dt, J

1=?^, J

2=1.2,

IH), 4.78 (s, IH), 4.49 (s, IH), 2.69 (d, J=3.9, IH), 2.40-2.29 (m,

2H), 2.12 (d, J=3.1, IH), 1.75 (s, 3H), 1.72-1.64 (m, 3H), 1.59-1.51 (m,

IH), 1.47-1.36 (m, 2H), 130-1.21 (m, 2H), 1.09 (s, 3H).

13C NMR: 195.2, 165.5, 155.2, 139.1, 100.3, 46.8, 44.8, 44.7, 39.4, 37.1 , 29.6, 24.9, 23.7, 22.6, 9.1.

H) Preparation of a compound (IV): Acetic acid

2-methyl-5-(2-methyl-3-methylene-

bicyclo[2.2.1]hept-2-exo-yl)-penta-l,3-dienyl ester To a stirred

solution of 2-methyl-5-(2-methyl-3-methylene-bicyclo[2.2.1]hept-2-yl)-

pent-2-enal (268.0 mg, 1.23 mmol) in toluene (3.0 ml) were added Ac

2O (0.35 ml, 3.70 mmol), Et

3N

(0.70 ml, 5.02 mmol), and a catalytic amount of DMAP (15.0 mg, 0.1

mmol). The resulting mixture was heated to reflux for 22 hours. The

mixture was cooled down to room temperature and quenched with brine,

extracted twice with Et

2O, dried over MgSO

4,

filtered off and concentrated to give a crude which was further purified

by flash chromatography with cyclohexane/AcOEt (98/2) to afford the

title compound in 82% yield (E:Z=79:21).

1H NMR: 7.18 (s, IH), 5.99 (d, J=12.4, IH), 5.72 (dt, i

l=\2A, J

2=6.1,

IH), 4.76 (s, IH), 4.47 (s, IH), 2.68 (d, 3.4, IH), 2.17 (s, 3H),

2.12-2.01 (m, 2H), 1.81 (d, J=I.0, 3H), 1.73-1.63 (m, 3H), 1.43-1.39 (m,

2H), 1.27-1.18 (m, 2H), 1.02 (s, 3H).

13C NMR: 167.9, 165.5, 134.4, 130.6, 126.9, 120.7, 100.0, 46.9, 45.3, 45.0, 44.5, 37.0, 29.7, 23.6, 23.0, 20.8, 10.4.

Hi) Preparation of(2Z)-Acetic acid 2-methyl-5-(2-methyl-3-methylene-bicyclo[2.2.1] hept-2-exo-yl)-pent-2-enyl ester (VII)

Acetic acid

2-methyl-5-(2-methyl-3-methylene-bicyclo[2.2.1]hept-2-exo-yl)-penta-l,3-

dienyl ester (6.80 g, 93% pure; 24.3 mmol0.18 mmol) was treated with

[(Cp*)Ru(COD)]BF

4 (52 mg, 0.122 mmol) and maleic acid (230 mg, 1.95 mmol) in dry and degassed acetone (20 ml) at 60

0C under 4 bars of H

2 for 24 hours. The product was extracted with pentane/5% NaOH, washed twice with saturated aqueous NaCl, dried

(Na

2SO

4) and bulb-to-bulb

distilled: 6.80 g (81% Z and 5% E by GC; 92%). 1H NMR: 5.38 (t, J=7.1,

IH), 4.73 (s, IH), 4.59 (s, IH), 4.45 (s, IH), 2.66 (br s, IH),

2.12-2.04 (m, 4H), 2.07 (s, 3H), 1.73 (d, J= 1.0, 3H), 1.69-1.61 (m, 3H), 1.45-

1.37 (m, 2H), 1.27-1.17 (m, 3H), 1.04 (m, 3H).

13C NMR: 171.1, 166.1, 131.4, 129.4, 99.7, 63.2, 46.8, 44.7, 44.6, 41.2, 37.1, 29.7, 23.7,

23.4, 22.6, 21.5, 21.0.

................

see

http://pubs.rsc.org/en/content/articlelanding/2014/ob/c3ob42174k#!divAbstract

Biocatalyst mediated regio- and stereo-selective hydroxylation and epoxidation on (

Z)-α-santalol were achieved for the first time, using a fungal strain

Mucor piriformis. Four novel metabolites were characterized as 10,11-

cis-β-epoxy-α-santalol, 5α-hydroxy-(

Z)-α-santalol, 10,11-dihydroxy-α-santalol and 5α-hydroxy-10,11-

cis-β-epoxy-α-santalol. Using Amano PS lipase from

Burkholderia cepacia, α- and β-isomers of 10,11-

cis-epoxy-α-santalol were resolved efficiently.

.png)