Ospemifene is useful for treating menopause-induced vulvar and vaginal atrophy; while fispemifene is useful for treating symptoms related with male androgen deficiency and male neurological disorders.

In July 2016, Newport Premium™ reported that Olon was potentially interested in ospemifene and holds an active US DMF for ospemifene since September 2015. Olon's website also lists ospemifene under R&D APIs portfolio.

PROCESS FOR THE PREPARATION OF OSPEMIFENE AND FISPEMIFENE

OLON S.P.A. [IT/IT]; Strada Rivoltana, Km. 6/7 20090 Rodano (MI) (IT)

| CRISTIANO, Tania; (IT). ALPEGIANI, Marco; (IT) |

Process for preparing ospemifene or fispemifene, by reacting a phenol with an alkylating agent.

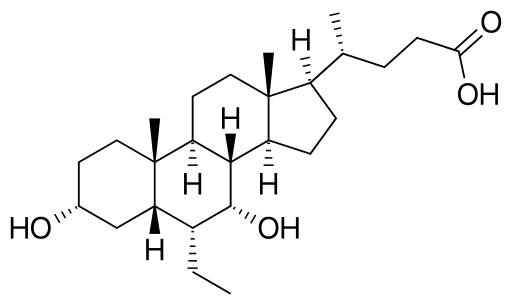

Ospemifene, the chemical name of which is 2-{4-[(lZ)-4-chloro-l,2-diphenyl-l-buten-l-yl]phenoxy}ethanol (Figure), is a non-steroidal selective oestrogen-receptor modulator (SERM) which is the active ingredient of a medicament recently approved for the treatment of menopause-induced vulvar and vaginal atrophy.

The preparation of ospemifene, which is disclosed in WO96/07402 and WO97/32574, involves the reaction sequence reported in Scheme 1 :

Ospemifene

Scheme 1

The first step involves alkylation of 1 with benzyl-(2-bromoethyl)ether under phase-transfer conditions. The resulting product 2 is reacted with triphenylphosphine and carbon tetrachloride to give chloro-derivative 3, from which the benzyl protecting group is removed by hydrogenolysis to give ospemifene.

A more direct method of preparing ospemifene is disclosed in WO2008/099059 and illustrated in Scheme 2.

Ospemifene

Scheme 2

Intermediate 5 (PG = protecting group) is obtained by alkylating 4 with a compound X-CH2-CH2-O-PG, wherein PG is a hydroxy protecting group and X is a leaving group (specifically chlorine, bromine, iodine, mesyloxy or tosyloxy), and then converted to ospemifene by removing the protecting group.

Alternatively (WO2008/099059), phenol 4 is alkylated with a compound of formula X-CH2-COO-R wherein X is a leaving group and R is an alkyl, to give a compound of formula 6, the ester group of which is then reduced to give ospemifene (Scheme 3)

Ospemifene

Scheme 3

Processes for the synthesis of ospemifene not correlated with those reported in schemes 2 and 3 are also disclosed in the following documents: CN104030896, WO2014/060640, WO2014/060639, CN103242142 and WO201 1/089385.

Fispemifene, the chemical name of which is (Z)-2-[2-[4-(4-chloro-l,2-diphenylbut-l-enyl)phenoxy]ethoxy]ethanol (Figure) is a non-steroidal selective oestrogen-receptor modulator (SERM), initially disclosed in WOO 1/36360. Publications WO2004/108645 and WO2006/024689 suggest the use of the product in the treatment and prevention of symptoms related with male androgen

deficiency. The product is at the clinical trial stage for the treatment of male neurological disorders.

According to an evaluation of the synthesis routes for ospemifene and fispemifene described in the literature, those which use compound 4 (Schemes 2 and 3) are particularly interesting, as 4 is also a key intermediate in the synthesis of toremifene, an oestrogen-receptor antagonist (ITMI20050278).

Leaving group X of the compound of formula 7 is preferably a halogen, such as chlorine, bromine or iodine, or an alkyl or arylsulphonate such as mesyloxy or tosyloxy.

In one embodiment of the invention, in the compound of formula 7, X is a leavmg group as defined above and Y is -(OCH2CH2)nOH wherein n is zero, and the reaction of 7 with 4 provides ospemifene, as reported in Scheme 4.

Scheme 4

In another embodiment of the invention, in the compound of formula 7, X and Y, taken together, represent an oxygen atom, the compound of formula 7 is ethylene oxide, and the reaction of 7 with 4 provides ospemifene, as reported in Scheme 5.

Scheme 5

In another embodiment of the invention, X is a leaving group as defined above and n is 1, and the reaction of 7 with 4 provides fispemifene, as reported in Scheme 6.

Scheme 6

The reaction between phenol 4 and alkylating reagent 7, wherein X is a leaving group as defined above and Y is the -(OCHbCEh^OH group as defined above, can be effected in an aprotic solvent preferably selected from ethers such as tetrahydrofuran, dioxane, dimethoxyethane, tert-butyl methyl ether, amides such as N,N-dimethylformamide, Ν,Ν-dimethylacetamide and N-methylpyrrolidone, nitriles such as acetonitrile, and hydrocarbons such as toluene and xylene, in the presence of a base preferably selected from alkoxides, amides, carbonates, oxides or hydrides of an alkali or alkaline-earth metal, such as potassium tert-butoxide, lithium bis-trimethylsilylamide, caesium and potassium carbonate, calcium oxide and sodium hydride.

The reaction can involve the formation in situ of an alkali or alkaline earth salt of phenol 4, or said salt can be isolated and then reacted with alkylating reagent 7. Examples of phenol 4 salts which can be conveniently isolated are the sodium salt and the potassium salt. Said salts can be prepared by known methods, for example by treatment with the corresponding hydroxides (see preparation of the potassium salt of phenol 4 by treatment with aqueous potassium hydroxide as described in document ITMI20050278), or from the corresponding alkoxides, such as sodium methylate in methanol for the preparation of the sodium salt of phenol 4, as described in the examples of the present application.

Example 1

Sodium hydride (4.2 g) is loaded in portions into a solution of 4-(4-chloro-l,2-diphenyl-buten-l-yl)phenol (10 g) in tetrahydrofuran (120 ml) in an inert gas environment, and the mixture is maintained under stirring at room temperature for 1 h. 2-Iodoethanol (11 ml) is added dropwise, and the reaction mixture is refluxed for about 9 h. Water is added, and the mixture is concentrated and extracted with ethyl acetate. The organic phase is washed with sodium carbonate aqueous solution and then with water, and then concentrated under vacuum. After crystallisation of the residue from methanol-water (about 5: 1), 9.9 g of crude ospemifene is obtained.

Example 2

A solution of sodium methylate in methanol (6.25 ml) is added to a solution of 4-(4-chloro-l,2-diphenyl-buten-l-yl)phenol (10 g) in methanol (100 ml) in an inert gas environment, and maintained under stirring at room temperature for 1 h. The mixture is concentrated under vacuum and taken up with tetrahydrofuran (100 ml). A solution of 2-iodoethanol (3.5 ml) in tetrahydrofuran (30 ml) is added dropwise, and the reaction mixture is refluxed for about 3 h. Water is added, and the mixture is concentrated and extracted with ethyl acetate. The organic phase is washed with a saturated sodium hydrogen carbonate aqueous solution, and finally with water. The resulting solution is then concentrated under vacuum and crystallised from methanol-water to obtain 5.8 g of crude ospemifene.

Example 3

Potassium tert-butylate (2.0 g) is added to a solution of 4-(4-chloro-l,2-diphenyl-buten-l-yl)phenol (5 g) in tert-butanol (75 ml) in an inert gas environment, and maintained under stirring at room temperature for 1 h. The solvents are concentrated under vacuum, and the concentrate is taken up with tetrahydrofuran (50 ml). A solution of 2-iodoethanol (1.7 ml) in tetrahydrofuran (15 ml) is added in about 30 minutes, and the reaction mixture is then refluxed for about 2 h. The process then continues as described in Example 1, and 2.9 g of crude ospemifene is obtained.

Example 4

A 50% potassium hydroxide aqueous solution (4.4 ml) is added to a solution of 4-(4-chloro-l,2-diphenyl-buten-l-yl)phenol (2 g) in toluene (20 ml) in an inert gas environment, and maintained under stirring at room temperature for 15

minutes. 2-Iodoethanol (2.2 ml) is added in about 30 minutes, and the reaction mixture is refluxed and maintained at that temperature for about 7 h. After the addition of water, the phases are separated. The organic phase is washed with a saturated sodium hydrogen carbonate aqueous solution, and finally with water. The organic phase is then concentrated under vacuum. After crystallisation of the residue from methanol-water (about 5:1), 0.85 g of crude ospemifene is obtained.

//////NEW PATENT, WO 2016108172, OSPEMIFENE AND FISPEMIFENE, OLON S.P.A.

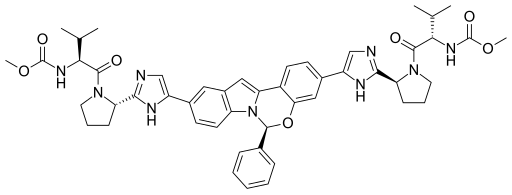

ENTECAVIR, BARACLUDE

ENTECAVIR, BARACLUDE

Rilpivirine

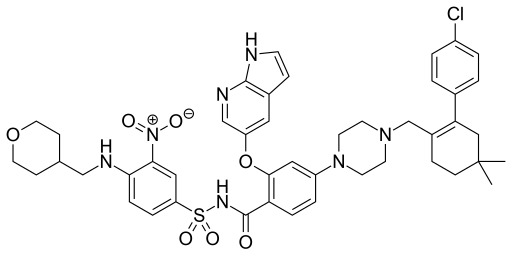

Rilpivirine Elbasvir

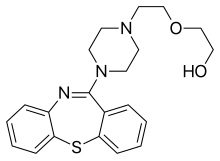

Elbasvir Quetiapine

Quetiapine